Other days, you need to as well as manage the very least equilibrium or discovered the very least count directly in dumps inside the a-flat period of time. Lead deposits are usually identified as digital money for example paychecks, retirement benefits out of a manager and you can government benefit costs, along with Societal Defense. Certain financial institutions may need you to get being qualified direct deposits inside 60 days out of membership beginning. For each and every strategy are evaluated centered on their bonus number and requirements, as well as the get back to the put (how much you get while the a percentage from how much your’re also needed to put). Western Airlines now offers three other checking is the reason adult consumers, and a teenager/more youthful adult examining for customers old 13 so you can twenty five. The membership possibly haven’t any month-to-month fees or charges that can end up being waived, albeit that have a direct put otherwise lowest daily balance.

- If you do 15,100 in the a-1percent savings account, you’re simply going to earn 75 of interest thereon money in half a year.

- If you’ve got the cash lying up to and don’t perform far hanky-panky along with your Pursue handmade cards, so it render is worth a peek.

- I may become a nervous Nellie, but I get a lot of worth away from my personal reference to Chase and i’d want to stick to the new safe-ish front.

- The most popular Chase bank account is the Overall Bank account since the month-to-month solution commission is waived for those who have simply step one lead deposit from five hundred or higher throughout the per report months.

It’s an easy task to speed up cash in and you may away from any membership – take action after at the start, then you definitely don’t need to contemplate it once more. Specific checking account bonuses is actually nationwide inside extent, which means you can now unlock a bank account and you will secure the new added bonus, irrespective of where you are living. You’ll should look in the bank account bonus and then make yes you’re eligible for it according to your location.

Cash Application and functions similarly to a bank checking account, offering profiles a good debit card — named a great “Bucks Card” — enabling them to make purchases by using the fund within their Bucks Application membership. The fresh app in addition to lets profiles to invest their funds inside the holds and purchase market bitcoin. As a whole, there is absolutely no cover on the level of examining otherwise put membership you’ll have open, while you’re capable create all of them effortlessly. Citi’s Availability Family savings charge a great 5 monthly services commission which is often waived from the fulfilling certain conditions. There aren’t any overdraft charge, and you will users have access to a network in excess of 65,one hundred thousand commission-free ATMs.

- SoFi does costs an exchange payment to help you techniques for every outgoing cable import.

- The standard FDIC insurance policies restriction are 250,000 for each account manager.

- To help you qualify for the bonus, you must receive at the least cuatro,100000 within the being qualified head dumps in this 3 months away from account starting, which may be problematic for many people to complete.

- A fundamental put comes up on your savings account within one to three business days.

Exactly how Safer Is Bucks App?

Before starting a free account, you’ll need to opinion the types of checking membership readily available and select one that meets your allowance and you may monetary conditions. And you may don’t disregard that when you have a Chase checking otherwise deals account, you could potentially recommend members of the family and you will earn more bucks incentives. Bankrate.com are a different, advertising-served creator and evaluation solution. We’re settled in exchange for keeping of backed services characteristics, or by you clicking on particular hyperlinks printed to the the web site. While we strive to render an array of also provides, Bankrate does not include factual statements about all the financial or borrowing equipment otherwise service.

Can you score taxed to the bank incentives?

Merely register for direct deposit together with your most recent otherwise the newest SoFi Examining and Family savings becoming qualified. Once again, this is simply not a most-comprehensive number and that is really and truly just a typical example of actions I’ve always lead to lead deposits. Learning that which works while the a direct deposit is really much more from a go and you can mistake type issue, so that you’ll often have to use several answers to find out if one thing codes as the a primary deposit. Make sure to shop around ahead if you’re also attending “fake” a primary put. Below are a listing of profile I generally used to lead to head dumps.

College Checking – one hundred

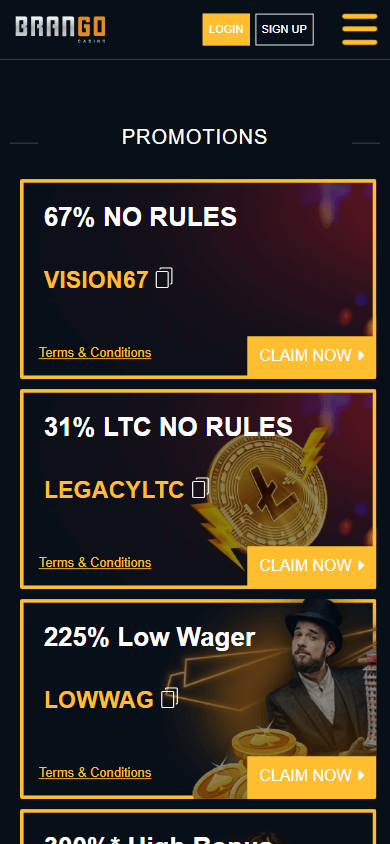

You wear’t you desire big money transferred which have Chase to profit out of the brand new Sapphire Family savings. You’ll features several options according to the money you owe and choices. If you’re students or an army affiliate, you’ll see special account 300 deposit bonus casino websites that will be designed particularly to your demands. “It’s better to measure the benefit than it is to help you improve the speed on what your’re also spending for the dumps,” states Greg McBride, CFA, Bankrate master financial analyst. After you’ve accomplished these procedures, you’ll found your own 100 bonus within this 15 days. Using this feature, you might put a by taking a graphic from it with your mobile device and you will getting using their app.

Chase is offering an excellent 500 incentive to possess setting up a verifying and you may savings account. Chase is additionally among a few examining accounts for the market to provide a signup extra to possess beginning a merchant account. Rating a 300 added bonus once you discover so it membership and set upwards head deposit within this ninety days. Although not, you shouldn’t open it make up that it reason alone.

Lender out of The usa Private Savings account

You just have to join having fun with another hook away from a Revolut mate and then make you to definitely qualifying exchange from from the minimum 1 along with your real otherwise virtual Revolut credit. Generally, debt business get legislation in position up to after you can be romantic your bank account after gathering a plus. For many who intimate your account once making finances extra, you’re obligated to pay a penalty otherwise forfeit you to definitely bonus.

It provide, which includes a plus all the way to 700, is a straightforward bonus to possess beginning another private otherwise mutual broker membership, if you don’t a timeless otherwise Roth IRA. Morgan Self-Led Investing and you will meet a number of conditions, you can make a welcome bonus all the way to 700. You’ll score unlimited fee-online inventory, ETF, and you may alternatives trades. Looking at the all in 900 both for requirements, I say it’s beneficial. Additional benefits is access to their free credit history and you may alerts in order to select fraud that have Chase Borrowing Journey. Chase Secure Financial℠ consumers will also get use of Pursue Earliest Banking℠, a merchant account to help parents instruct kids and children on the currency.

SoFi Examining and Family savings: As much as 3 hundred bonus

When you are a doing financial coach, Jeff try called to Investopedia’s famous listing of Finest a hundred advisors (as much as #6) many times and you will CNBC’s Electronic Advisory Council. Jeff is actually an enthusiastic Iraqi handle experienced and you will supported 9 decades inside the fresh Military Federal Guard. Their efforts are on a regular basis seemed in the Forbes, Company Insider, Inc.com and you may Business person. Pursue in past times just met with the choice to discover a free account within the person, nevertheless currently have the fresh availableness to get it done myself online, as well.

New clients may also secure a three hundred added bonus once they open a different account and you may discovered qualifying lead dumps. For many who’re also going to opt for checking account incentives, I typically strongly recommend having at the least 5,100 that you could invest exclusively to have savings account bonuses. Very banking institutions will need one perform some level of head dumps and you will/or if you’ll need to keep certain minimal harmony to prevent costs. Generally, 5,100 will likely be enough you should do very savings account bonuses.